The 5-Second Trick For Mortgage Refinance Deal

Wiki Article

Unknown Facts About Best Refinance Deals

Table of Contents8 Easy Facts About Refinance Deals ShownThe 30-Second Trick For Refinance Deals5 Simple Techniques For Refinance DealsThe 10-Minute Rule for Best Refinance DealsBest Home Loan Refinance Offers Can Be Fun For Everyone

Wondering if refinancing is the right step for you? Try to obtain a concept of what the overall price atmosphere looks like. Use Smart, Asset's price comparison device as a starting factor. If you're still trying to find a residence, it can be daunting to find the appropriate home for you.

Mortgage Refinancing is when a debtor either changes their home mortgage product with a various one that typically has a reduced rate under their existing or a brand-new lending institution. It indicates changing your existing finance for a new one and in a lot of instances, with a new bank. The 2 main reasons individuals aim to refinance their home financings are either to get a better rate or to raise their existing lending to take out some home equity.

The Of Refinance Deals

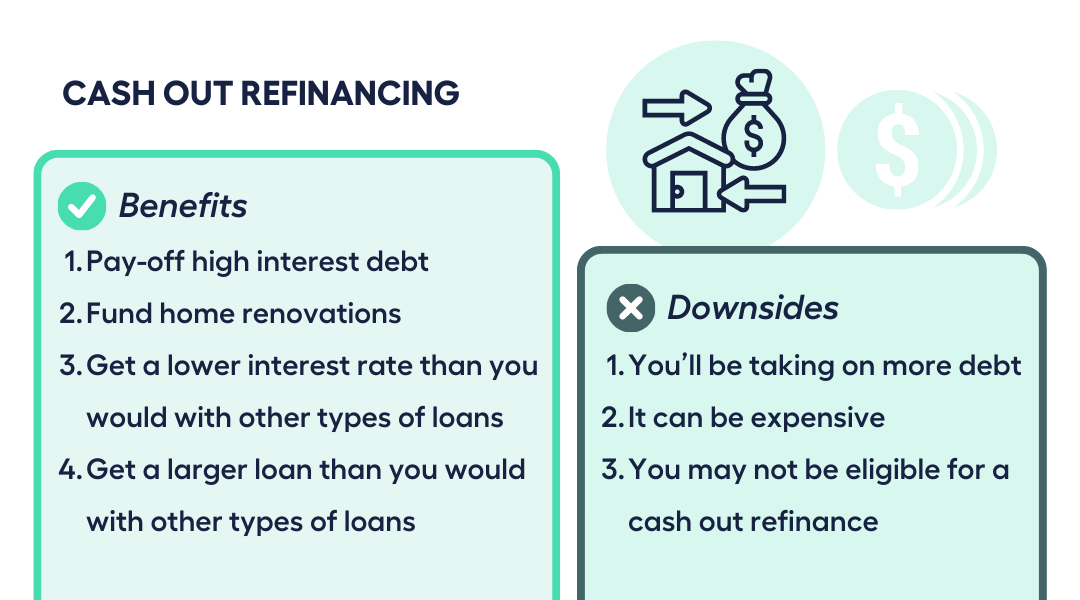

These days, banks do not award commitment, and in many cases we find loan providers use far better bargains to new clients as opposed to compensating their existing ones. A refinance home mortgage describes the mortgage product customers switch over to. Lenders occasionally offer a different set of home mortgage with their particular prices and features for refinancing applications.However, there are several kinds of refinancing based on transactions with lenders. Here are some of one of the most usual kind of refinancing: Kind Summary Cash-out refinance This option allows you to take a new loan on the residential or commercial property on top of your present financing utilizing your equity. Basically, you liquidate your ownership of the home to get some money that you can utilize for remodellings, repairs, and even for a down payment for your next home purchase.

This raises your equity while reducing your loan-to-value ratio. It will certainly likewise lower your monthly commitments. Rate-and-term refinance Among the most usual reasons for refinancing is accessing a far better rate or renegotiate loan terms. Under this alternative, you are able to alter your interest rate or include car loan attributes.

Rumored Buzz on Best Refinance Deals

Loan consolidation refinance Refinancing to put all your existing financial debt right into a single financing account is called combination. mortgage refinance deal. With financial debt consolidation, you are able to complete settling various other personal debts, enabling you to concentrate on simply one line of credit history. This functions ideal if you have a home mortgage that has a reduced passion price and marginal costs

The difference, nevertheless, is that reverse home loan owners do not need to clear up settlements. Still, nonetheless, there are prices that have to be paid throughout the loan. Make sure to study the risks associated by reverse mortgage before discovering this alternative. What are some factors for refinancing? It is mosting likely to boil down to your individual circumstance, and your own short to tool term objectives.

Getting My Best Home Loan Refinance Offers To Work

On the various other hand, spreading out your car loan for a few even more years will aid relieve the financial problem. This, however, will certainly lead to you paying even more rate of interest over use this link time. Make note that Lenders and Bank might have different problems on allowing your Home Lending Refinancing, review this message: If you presently have a variable mortgage and you wish to be able to safeguard your rate of interest, you will require to re-finance to a fixed-rate home loan.try this website This suggests that the proportion of the complete value of your home that you really possess boosts. Many debtors take benefit of their equity by refinancing. If the housing market is on the advantage, there is a massive chance that their residential properties have actually appreciated. Refinancing will enable you to take a section of your built-up equity and utilize it to fund any kind of big purchase, such as an investment property, a new automobile, or an improvement.

The new valuation will help your lender determine your loan-to-value ratio and how much you may be able to obtain. One vital point to bear in mind is to make certain that as high as feasible, your equity is greater than 20% of your residential property's worth. This method, you will not go through paying for Lenders Mortgage Insurance Policy.

The 45-Second Trick For Refinance Deals

If you require a guide on Home look here Equity Loans in Australia, read this message: Lastly, you can re-finance to settle other fundings and financial obligations into a solitary and potentially much more economical payment. This can be handy in scenarios where you have high-interest rate lendings and debts like credit history cards, personal loans or auto finances.Your old home mortgage will be changed by a new one that consists of the amount you used to pay those other financial debts. Financial obligation consolidation functions well if you have lots of various charge card and are paying very high-interest prices. The only downside when settling debts is to think about the new finance term and what the total rate of interest costs will be after you have settled everything.

Report this wiki page